Accessing credit efficiently and responsibly is crucial for both businesses and individuals. Concora Credit is a versatile and beneficial solution among the various credit options. But what is Concora Credit? It’s a financial partner committed to empowering individuals and businesses with tailored credit solutions. Their focus is on empowering non-prime consumers through accessible and responsible credit.

If you’re a business owner looking to manage cash flow or an individual seeking flexible credit options, it can help you make informed financial decisions.

Here, you’ll explore everything you need to know about it before applying.

What is Concora Credit?

It is a financial services company that provides credit solutions to non-prime consumers and businesses. In Q2 2025, U.S. credit card balances reached about $1.21 trillion, and total household debt stood near $18.39 trillion (New York Fed). These record levels highlight the growing demand for non-prime credit and repayment tools that companies like Concora Credit provide.

They offer a variety of credit card products tailored to different needs, including credit building and business management. It is committed to responsible lending and customer-first service, aiming to help individuals and businesses achieve their financial goals.

Here are some key achievements and offers they provide –

- They have been in business for over 20 years.

- They have served over 2 million customers.

- It has a 95% customer satisfaction rating.

- It offers various credit card products, including the Milestone Mastercard, Indigo Mastercard, Earniva Business Mastercard, and Destiny Mastercard.

- They also provide private-label credit card programs to merchants.

It is a viable and accessible option for individuals and businesses seeking credit solutions. They offer a variety of products and services that can help you achieve your financial goals. If you’re looking to build your credit, manage your business expenses, or enjoy the convenience and security of having a reliable credit card.

If you are applying for this, then click here.

How Does Concora Credit Work?

They partner with banks to offer premium credit cards designed for individuals with a fair or limited credit history. It provides various credit card options with different features and benefits to help consumers build or rebuild their credit scores through responsible use. They offer financing solutions for businesses, enabling them to extend credit to customers who might not qualify for traditional financing.

They aim to make credit more accessible and inclusive, helping people achieve their financial aspirations while promoting responsible borrowing habits. Its customer-centric approach prioritizes clear communication and support throughout the credit journey. Its commitment to transparency builds trust and empowers consumers to make informed decisions about their financial well-being. They clearly outline all fees and terms.

“Concora was the first to give me a chance when others turned me down. Seeing my credit improve has been a relief,” said Daniel, a small business owner.

Related – Credit Card Referral Bonuses – The Ultimate Guide

Benefits of Using Concora Credit

It offers a wealth of benefits designed to empower businesses and individuals. If aiming to improve your cash flow, prepare for the unexpected, build credit, or save money on financing, it has a solution to fit your needs. Promoting responsible borrowing and providing educational resources encourages financial well-being and growth.

Let’s delve deeper into the advantages of opting for credit –

- Improved Cash Flow Management – For businesses, having access to a flexible line of credit can significantly improve cash flow management. It ensures you can cover operating expenses, payroll, and other costs without interruption. This stability lets you focus on growth and strategic planning.

- Emergency Funding – Emergencies can arise unexpectedly if you’re a business or an individual. Having a line of credit means you can access emergency funds quickly without going through the lengthy process of applying for a loan. Quick access to funds is crucial for emergencies.

- Build Credit History – Responsibly using and repaying your Concora Credit can help build your credit history, improving your credit score over time. A more robust credit score can open doors to better financing options and lower interest rates in the future, further enhancing your financial health.

- Lower Costs Compared to Other Credit Options – With competitive interest rates and flexible terms, it can be more affordable than other short-term financing options, such as payday loans or high-interest credit cards. By choosing this credit, you can save money on interest and fees.

Features of Concora Credit

It isn’t just about access to funds; it’s about empowering you with tools to manage your finances effectively. Focusing on transparency and customer-centricity, they aim to simplify the credit experience and provide solutions that adapt to your unique circumstances. They offer a straightforward application process and quick approvals.

Let’s explore the key features that make a versatile and convenient financial partner –

- Flexible Borrowing – With this credit, you can borrow up to a pre-approved limit without the need to reapply each time you need funds. This flexibility is ideal for managing cash flow, unexpected expenses, or short-term financial needs. It allows you to access funds precisely when required.

- Revolving Credit Line – Like a credit card, it is a revolving line of credit. As you repay the borrowed amount, your available credit replenishes, allowing you to borrow again if needed. This ongoing access to credit helps maintain liquidity and supports continuous financial operations.

- Competitive Interest Rates – It offers competitive interest rates on its credit lines, making it a cost-effective solution compared to other forms of credit. Lower interest costs mean you can save money over time, freeing up resources for other important financial commitments.

- Easy Access to Funds – Funds from your credit line can be accessed quickly and easily, often through online transfers, ensuring you have the money you need when you need it. This convenience reduces the hassle of traditional loan processes and speeds up access to capital.

- Customizable Repayment Options – It provides various repayment plans, allowing you to choose a schedule that aligns with your financial situation and goals. Tailored repayment options ensure you can manage debt effectively without compromising other financial priorities.

Does Concora Credit Give Credit Increases?

Yes, Concora Credit does provide credit increases, but approval depends on payment history, account standing, and responsible use. Furthermore, Concora accounts are reviewed automatically every 6 to 12 months, though some customers need to request an increase.

Keeping credit utilization under 30% and maintaining at least six months of timely payments can improve approval chances.

Requests may involve either a soft check or a hard inquiry, so it is best to confirm with Concora before applying.

Overall, responsible management plays the biggest role in securing a higher limit.

“After nine months of steady payments, my limit increased by $300 automatically. It gave me confidence to keep rebuilding,” shared Maria, a Concora cardholder.

Pricing and Fees

Before applying for a card, it’s crucial to understand the associated costs. Each card has its own set of fees and interest rates, catering to different needs and credit profiles. These costs can significantly impact the overall affordability of the card and your ability to manage your finances effectively.

Here’s a summarizing the pricing and fees for each of the credit cards –

| Feature | Milestone Mastercard | Indigo Mastercard | Destiny Mastercard | Earniva Business Mastercard |

| Annual Fee | $35 – $99 | $0 – $99 | $59 – $99 | $0 – $49 |

| APR for Purchases | 24.90% | 24.90% | 24.90% | 15.99% |

| Foreign Transaction Fee | 1% of each transaction | 1% of each transaction | 1% of each transaction | 0% |

| Late Payment Fee | Up to $40 | Up to $40 | Up to $40 | Up to $39 |

| Cash Advance Fee | $5 or 5% (whichever is greater) | $5 or 5% (whichever is greater) | $5 or 5% (whichever is greater) | $5 or 3% (whichever is greater) |

| Credit Limit | $300 – $700 | $300 – $1,000 | $300 – $700 | $500 – $10,000 |

| Balance Transfer Fee | Not available | Not available | Not available | 3% of the amount transferred |

| Penalty APR | None | None | None | Up to 29.99% |

Important Notes –

- Milestone Mastercard – It is designed for rebuilding credit with a moderate annual fee and straightforward terms.

- Indigo Mastercard – Offers flexible annual fees based on creditworthiness and includes essential features for credit rebuilding.

- Destiny Mastercard – Similar to the Milestone and Indigo cards, it focuses on credit building with a range of annual fees.

- Earniva Business Mastercard – They are tailored for small business needs, offering a higher credit limit, lower APR, and no foreign transaction fees.

Please note – These are general pricing and fee details. Please refer to Concora Credit’s official website or cardholder agreements for the most accurate and up-to-date information.

Milestone Mastercard

Those who are looking to build or rebuild their credit can effectively utilize the Milestone Mastercard. Notably, it features a moderate annual fee of $35-$75 and offers straightforward terms, making it particularly accessible for individuals with limited credit history. Although it may not provide rewards or extensive benefits, its primary focus remains on promoting responsible credit usage while ensuring regular reporting to major credit bureaus.

Indigo Mastercard

The Indigo Mastercard offers flexibility in annual fees based on your creditworthiness, ranging from $0-$99. As a result, it becomes a suitable option for those with fair credit. Furthermore, it provides essential features for rebuilding credit, including reporting to major credit bureaus and potential credit limit increases with responsible use. Notably, it boasts an average credit limit increase of $100 after six months for responsible users, making it a practical choice for those looking to improve their financial standing.

Destiny Mastercard

Like the Milestone and Indigo cards, the Destiny Mastercard primarily focuses on credit building. Additionally, it offers a range of annual fees depending on your creditworthiness, starting at $59, and provides access to a higher credit limit of up to $1,000 for qualified applicants. Moreover, it includes convenient online account management services, ensuring easy access to your financial information.

Earniva Business Mastercard

The Earniva Business Mastercard specifically caters to small business owners and entrepreneurs. Notably, it boasts a higher credit limit than consumer cards, and in addition, it may offer lower APRs, starting at 13.24%. Furthermore, it typically comes with no foreign transaction fees, which makes it ideal for businesses with international operations. Moreover, they also provide expense-tracking apps that help track and categorize business spending efficiently.

Also read – 10 Best Credit Cards Offering Priority Pass Lounge Access

Is One of These Credit Cards Right for You?

Choosing the right credit card largely depends on your financial goals and credit situation. For instance, the Milestone, Indigo, or Destiny Mastercards may be suitable options if you are looking to build or rebuild your credit. Additionally, each card offers varying annual fees and credit limits to accommodate different financial situations. More importantly, they report to major credit bureaus, which helps with positive credit building.

Furthermore, these cards provide convenient online account management tools, making it easier to monitor your progress and stay on track financially.

For business owners, the Earniva Business Mastercard offers valuable rewards and benefits. With features like no foreign transaction fees and higher credit limits, this card caters to the specific needs of small businesses. Expense management tools like PocketSmith can help streamline financial tracking, and the potential for lower APRs can make borrowing more affordable.

In the end, selecting one of these cards should be based on your unique needs and ability to manage payments effectively.

“Applying for the Indigo card helped me start rebuilding my credit, but the key was staying disciplined and making payments on time,” shared Mark, a recent cardholder.

Recommended read – Digital Business Credit Card: The Ultimate Tool to Elevate Your Business

How to Apply for Concora Credit

Applying for Concora Credit is a straightforward process designed to be convenient and user-friendly. It offers a variety of credit products tailored to individual needs and financial situations, making it easy to find the right card to meet your goals. If you’re looking to build credit, rebuild credit, or access financing for your business, Concora has a solution.

Here are some simple steps to help you through the application –

- Ensure you meet Concora’s criteria, including minimum credit score and income requirements, for the eligibility check.

- Prepare ID, income proof, and financial statements for a faster application process when gathering documentation.

- Fill out the form accurately on Concora’s website to avoid delays in the online application.

- Concora will assess your creditworthiness during credit evaluation, including a credit check and financial stability review.

- If approved, you’ll receive a credit limit based on your financial profile for approval and credit limit.

- Once approved, manage your account online and access funds as needed.

What is the Interest Rate for Concora?

Concora Credit’s cards typically carry a high annual percentage rate (APR) of 35.9%, making it costly to carry a balance.

For example, the Destiny Mastercard®, a Concora Credit product, has an APR of 35.9%. Additionally, certain private-label credit card programs under Concora Credit, such as the Raymour & Flanigan card, have an APR of 34.9%. Given these high interest rates, it’s advisable to pay off balances monthly to avoid substantial interest charges.

Missing payments or carrying a high balance can lead to even greater financial strain over time. Exploring lower-interest alternatives may be a better option for managing credit more affordably.

“I learned the hard way that carrying a balance on these cards can become overwhelming. Paying it off each month is the only way to stay ahead,” said Jennifer, a longtime cardholder.

Tips for Managing Concora Credit Responsibly

Managing your credit account is crucial for maintaining a healthy financial profile and achieving your goals. Responsible credit management involves understanding your spending habits. It makes timely payments and utilizes credit strategically to build a positive credit history and access financial opportunities.

Following these essential tips ensures that your credit account works for you, not against you –

- Budget Wisely – Track your income and expenses to understand your spending patterns.

- Pay on Time – Always make at least the minimum payment by the due date.

- Avoid Maxing Out – Low credit utilization (ideally below 30%).

- Monitor Statements – Review your monthly statements for errors or unauthorized charges.

- Set Payment Reminders – Use alerts or automatic payments to avoid missed due dates.

- Communicate with Concora – Contact customer service if you face financial difficulties.

- Build a Positive History – Use credit responsibly to improve your credit score.

- Limit Credit Applications – Applying for too much credit can negatively impact your score.

Customer Support

It offers comprehensive customer support, addressing your questions or concerns promptly. You can reach their team through various channels, including phone 866-502-6439, email sales@concoracredit.com, or live chat, for assistance with account inquiries, payment processing, and navigating the online self-service system.

Their dedicated support team is always available to guide you through making a payment or accessing your account online, which makes it easier and more convenient to manage your credit card. Furthermore, they consistently strive to provide prompt and helpful assistance, ensuring a seamless and positive customer experience at every step.

Cancellation Policy

If you decide credit is unsuitable, however, their cancellation policy is straightforward. Additionally, you can cancel your card at any time by contacting customer support. Before doing so, be sure to pay off any outstanding balance to avoid additional fees or interest charges. Yet, consider redeeming any rewards or benefits associated with your card before cancellation to maximize their value.

Here is an overview of cancellation details –

| Cancellation Policy | Details |

| Cancellation Process | Contact customer support via phone, email, or live chat to request cancellation of your card. |

| Outstanding Balance | Pay off any outstanding balance before cancelling to avoid additional fees or interest charges. |

| Cancellation Fees | There are no specific cancellation fees, but any outstanding balance must be paid in full. |

| Cancellation Timeframe | Your card will be cancelled upon request, and you will receive confirmation from customer support. |

Before cancelling your card, consider alternative options, such as reducing your credit limit or switching to a different credit card that better suits your needs.

Customer Ratings

Its cards have garnered mixed reviews from users. While many customers appreciate the accessibility for those with varying credit histories, ease of use, and responsive customer support, others have expressed concerns about high fees and interest rates. WalletHub’s rating of 3.4 out of 5 stars reflects this opinion diversity, based on over 8,800 reviews and 344 questions and answers.

Potential applicants should weigh these factors carefully, considering their financial situations and goals before deciding whether a card is the right choice. In addition, it is important to research and compare different credit card options to find the best fit for your needs.

Furthermore, reading customer reviews can offer helpful insights into real user experiences. Yet, understanding the terms and conditions of each card ensures you make a fully informed decision.

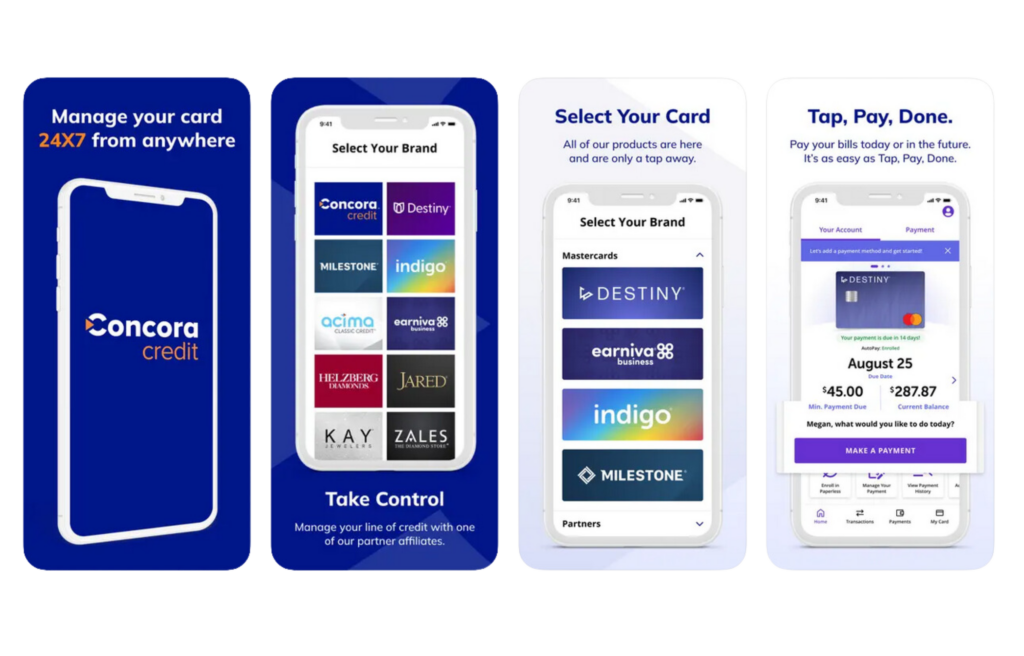

Is the Concora Credit Application Available?

Yes, you can apply for Concora Credit cards online through their user-friendly website or mobile app, which is available for Android and iOS devices. It has designed a quick and straightforward application process that typically provides decisions within minutes, allowing you to gain access to credit quickly.

To begin the application process, you first need to provide your basic personal and financial information. This includes your full name, current address, annual income, and employment details. Once submitted, the system carefully reviews your information. After that, it promptly determines your eligibility for a credit card.

Comparing Concora Credit to Other Credit Cards

When comparing Concora Credit to other credit cards, consider your specific needs. While Concora Credit is great for credit building and business expenses, cards like Chase Sapphire Preferred® offer high travel rewards, Citi® Double Cash Card provides simple cash back with no annual fee, and American Express® Gold Card is ideal for travellers with its dining and travel reward card.

Compare based on your spending habits so that you can find the best fit. Additionally, be sure to carefully review each card’s fees, APR, and additional benefits before making a final decision. This way, you can confidently select a card that aligns with your financial goals and lifestyle. Moreover, it is essential to choose a card that not only meets your immediate needs but also provides long-term value and benefits.

Final Note

Concora Credit has many credit cards to fit different needs, if you’re trying to build your credit or run a business. They’ve got flexible terms, decent perks, and helpful customer service, making them a solid option for folks who might not qualify for other cards. What’s cool about Concora is that they’re all about giving everyone a fair shot at credit, even if your credit history isn’t perfect.

Before you jump in and apply, take a good look at the nitty-gritty details of each card, like the fees and interest rates.

That way, you can pick the one that’s the best match for your money situation.

Need Guidance Choosing the Right Card?

If you need help determining which credit card best fits you, don’t worry! We’re here to help make your decision easier.

Also, we support relocation for professionals, students, families, and corporate clients to make transitions smoother.

Just schedule a meeting with us or fill out the short form.

We’ll respond quickly to assist you with your credit card solution and relocation support.

Affiliate Disclosure – This article contains affiliate links. We may earn a small commission at no additional cost if you purchase them. Please be assured that we only recommend products and services that meet our quality standards.