Managing finances across different countries can be challenging for a digital nomad or an international traveller. The number of digital nomads worldwide has reached approximately 40 million, with 18.1 million from the United States alone. It would help to have a list of the best bank accounts for digital nomads that cater to your lifestyle. It has low fees, robust online banking, multi-currency functionality, and widespread ATM access. This specialized banking solution should offer excellent customer support and easy mobile access.

It ensures that you can handle your finances trouble-free anywhere in the world. To frequent travellers, this would mean an ideal bank account that allows easy switching of currencies with low conversion costs.

Here’s a list of the best bank accounts to support your nomadic and travel lifestyle –

1. Revolut – Best for Multi-Currency Accounts

Revolut offers an excellent solution for digital nomads needing access to various currencies. As one of the best bank accounts for digital nomads, it sits firmly in the conversation around traditional banks vs neobanks, allowing users to hold and exchange more than 30 currencies at the real exchange rate. It also provides international ATM withdrawals, making it highly convenient for frequent travellers. Users enjoy free international transfers, adding even more value for global nomads.

Revolut’s innovative app also includes features such as built-in budgeting tools and instant transaction notifications, which are ideal for managing finances on the go. It makes it a powerful tool for currency management and a comprehensive financial companion that adapts to your dynamic lifestyle needs. Enhanced security features such as card lock/unlock functionality and location-based security add an extra layer of protection.

Features –

- Hold and exchange over 30 currencies

- Built-in budgeting tools

- Cryptocurrency exchange

- Instant spending notifications

Account Opening Fees – No opening fee; premium plans available.

Plans –

- Standard – Free

- Premium – $9.99/month

- Metal – $16.99/month

Strengths –

- Real-time transaction alerts.

- Free international ATM withdrawals up to $257.77 per month.

- Instant spending analytics.

- Robust security features, including card lock via app.

Limitations –

- Charges apply after $257 at ATMs.

- Customer service issues reported.

- Balances do not earn interest.

- Limited banking license status in some regions.

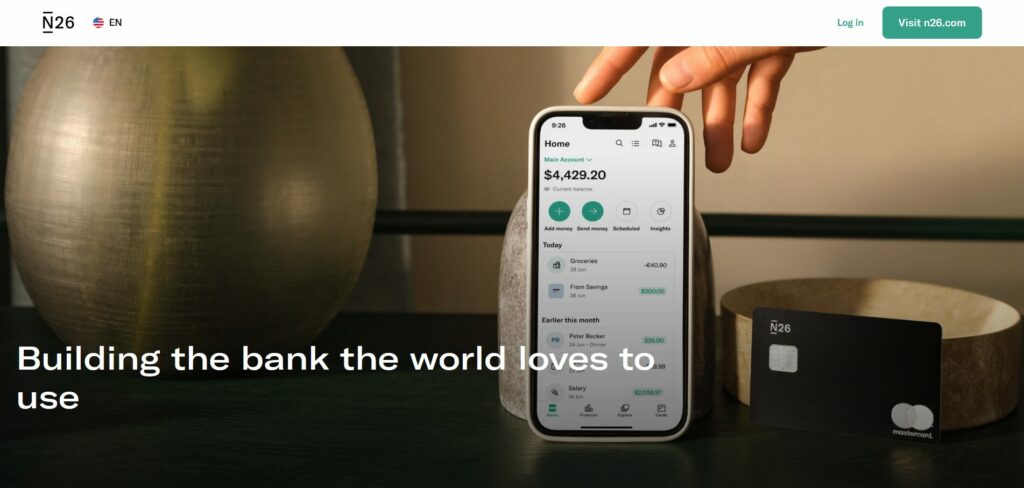

2. N26 – Top Choice in Europe

For European nomads, N26 provides a sleek, app-based banking experience with free ATM withdrawals in euros and real-time transaction notifications. It’s also expanding its services to the U.S., making it an excellent option for transatlantic travellers, bridging financial convenience across continents. N26 designs its banking platform with simplicity and transparency in mind.

It offers a streamlined interface that enhances user experience, making navigation and banking operations smooth and intuitive, which is ideal for digital nomads. It provides easy-to-understand fee structures and no hidden charges. They foster a transparent relationship between the bank and its customers, which is crucial for those seeking reliable banks for digital nomads.

Features –

- Free ATM withdrawals in euros

- Real-time transaction alerts

- Spaces feature for organizing savings

- Fee-free payments worldwide

Account Opening Fees – No account opening fees; various premium options available.

Plans –

- Standard – Free

- You – €9.90/month

- Metal – €16.90/month

Strengths –

- Transparent fee structure.

- Free payments worldwide in any currency.

- Innovative saving and budgeting features.

- Comprehensive app-based banking.

Limitations –

- Limited availability outside Europe and the U.S.

- There are no physical branches.

- Customer service can be slow.

- Deposit insurance up to €100,000 only.

?Related – Top 7 Digital Nomad Insurance Providers: Protecting Your Global Adventures

3. TransferWise Borderless Account – Best for Low Fees

Now known as Wise, the TransferWise Borderless Account is perfect for those who work with multiple currencies. It allows you to hold over 40 currencies. It provides a debit card to use worldwide at the mid-market exchange rate, ensuring you get the most favourable exchange rates without the typical banking markups. The account supports direct debits in several major currencies.

It is ideal for those who need to pay bills or subscriptions in different countries. This feature simplifies managing regular payments overseas, allowing for seamless financial transactions regardless of geographic boundaries. Its comprehensive services rank it among the top bank accounts for digital nomads, providing the flexibility and ease necessary for managing finances on a global scale. If you want to know more about how this can benefit your nomadic lifestyle, read our complete Wise online money transfer review.

Features –

- Hold 40+ currencies

- Local bank details for USD, GBP, EUR, AUD, and NZD

- Debit card available

- Low conversion fees

Account Opening Fees – No account opening fees; small conversion fees apply.

Plans – The available plan is free, and there is an optional £5 fee for a debit card.

Strengths –

- Mid-market exchange rates.

- Easy access to high-street banks.

- Mastercard debit card included.

- Efficient customer support.

Limitations –

- Conversion fees for some currencies.

- There are no physical branches for direct banking.

- ATM withdrawals are limited to two per month free.

- Delay in care delivery in some countries.

4. Charles Schwab – Best for Free ATM Withdrawals Worldwide

U.S. residents will find Charles Schwab particularly appealing, making it one of the best bank accounts for digital nomads due to its unlimited ATM fee rebates worldwide. This feature alone can save nomads considerable money in fees over time. The absence of foreign transaction fees on purchases further enhances its attractiveness for international travelers, making it easier to manage expenses without worrying about additional charges.

The integrated brokerage account allows account holders to invest globally without switching platforms, streamlining both banking and investment activities. Schwab’s robust mobile app enables customers to manage their finances efficiently on the move. It offers features like mobile deposit, investment tracking, and real-time alerts, which are essential for those constantly on the move.

For students studying abroad, Charles Schwab also stands out among the best banks for international students, offering financial flexibility and global access without excessive fees.

Features –

- Unlimited ATM fee rebates worldwide

- Online brokerage services

- No foreign transaction fees

- Excellent customer service

Account Opening Fees – No account opening fees; a linked brokerage account is required.

Plans – Include a Free High Yield Investor Checking Account linked to a complimentary brokerage account.

Strengths –

- There is no minimum balance or monthly service fees.

- Refund of all ATM fees worldwide.

- Excellent mobile app and customer service.

- Integrated investment services.

Limitations –

- U.S. residency is required.

- A high minimum for brokerage accounts is needed to avoid fees.

- Limited international fund transfer options.

- Primarily an investment-focused institution.

5. HSBC Expat – Best for International Banking Services

HSBC Expat is designed for those living abroad, offering multiple currencies, the best bank accounts for digital nomads, and easy access to global transfers. It’s ideal for nomads needing a reliable international banking solution. HSBC Expat provides tailored financial advice to help you manage your finances efficiently across different countries, enhancing its status as a top choice for banks for digital nomads.

The service also includes access to HSBC’s worldwide network of branches and ATMs, offering convenience and security wherever you find yourself. Their online and mobile banking platforms have advanced security features, protecting your financial data against unauthorized access. This comprehensive support system makes HSBC Expat a robust partner for managing international finances seamlessly.

Features –

- Multi-currency accounts

- Global transfers

- Investment options

- Access to international financial advice

Account Opening Fees – No account opening fees, but minimum balance requirements apply.

Plans –

- Premier – Minimum £50,000 or currency equivalent to avoid fees

- Advance – Minimum £10,000 or currency equivalent to avoid fees

Strengths –

- Accessible in over 30 countries.

- Dedicated expat banking services.

- Attractive for high-net-worth individuals.

- Comprehensive international banking solutions.

Limitations –

- High minimum balance requirements.

- Complex fee structure for some services.

- Not ideal for low-balance customers.

- Limited digital tools compared to others.

6. Citibank – Best for Global Presence

With branches in major cities worldwide, Citibank offers convenience for digital nomads. Their global account access and ability to handle transactions in numerous currencies make them a solid choice. Citibank’s international banking services, including multi-currency accounts and global transfers, align with the needs of the digital nomads.

It ensures easy and seamless management of finances across borders. Their customer service team provides support in multiple languages. They enhance accessibility and ease remote work communication barriers for global clients. Citibank also offers tailored financial products that adapt to the changing economic landscape. They regularly update services to meet the changing needs of international clients.

Features –

- Global account access

- Linked investment services

- Multi-currency functionality

- Extensive ATM and branch network

Account Opening Fees – Varies by country; typically, there is no opening fee but minimum balance requirements.

Plans –

- Basic Banking – No monthly fee if a minimum balance is maintained

- Citi Priority – $30/month unless a $50,000 balance is maintained

- Citigold – No fee, requires $200,000 in combined average monthly balances

Strengths –

- Extensive branch network globally.

- Multiple currency accounts.

- Robust online banking platform.

- Preferential rates for premium customers.

Limitations –

- High fees for certain transactions.

- Minimum balance requirements are steep.

- Customer service quality varies by region.

- Complex fee structure.

?♀️ Also read – The 12 Countries That Offer Digital Nomad Visas in 2024

7. Monzo – Best for Budgeting While Traveling

UK-based Monzo helps digital nomads manage their finances with features like instant spending notifications, budgeting tools, and no fees on foreign spending under £200 a month. It makes it particularly appealing for those who travel frequently but want to keep a close eye on their expenses without worrying about racking up fees. Its user-friendly interface and intuitive app design simplify financial management.

They allow users to set budgets, categorize spending, and even save automatically, enhancing the overall travel experience. Beyond these tools, Monzo also offers ‘Pots’ for setting aside money for specific goals, which is excellent for managing savings for future travel plans or emergency funds.

Features –

- Instant notifications

- Budgeting tools

- Fee-free spending abroad under £200

- Savings Pots for goal-oriented saving

Account Opening Fees – No account opening or monthly fees.

Plans –

- Monzo Plus – £5/month

- Monzo Premium – £15/month

Strengths –

- Excellent budgeting and savings tools.

- There are no fees on foreign transactions up to a limit.

- Quick and easy setup.

- Strong focus on technology and security.

Limitations –

- Limited to U.K. residents.

- ATM withdrawal and foreign exchange limits.

- There are no physical branches.

- Less effective for non-GBP transactions.

8. Starling Bank – Best for Easy Money Management

Another U.K. favourite, Starling Bank, offers a straightforward, no-nonsense approach to banking with no fees on overseas spending or ATM withdrawals. It makes it perfect for those who travel frequently. Their innovative app also provides detailed insights into spending habits with categorization features that help users track and manage their finances efficiently.

This functionality is crucial for digital nomads managing budgets in various currencies. Starling, the best bank account for digital nomads, offers real-time notifications for each transaction, providing immediate updates on spending and ensuring security with alerts on potentially unauthorized transactions. The bank tailors its 24/7 customer support to handle inquiries from anywhere worldwide.

Features –

- No fees on overseas spending or ATM withdrawals

- In-app receipt capture

- Savings goals

- 24/7 customer support

Account Opening Fees – No account opening or monthly fees.

Plans – These are available for free for personal, joint, and business accounts.

Strengths –

- There are no fees internationally.

- Excellent customer service.

- User-friendly app.

- Competitive interest rates on balances.

Limitations –

- Available only in the U.K.

- Limited third-party integrations.

- There are no physical branches.

- Some business services can be pricey.

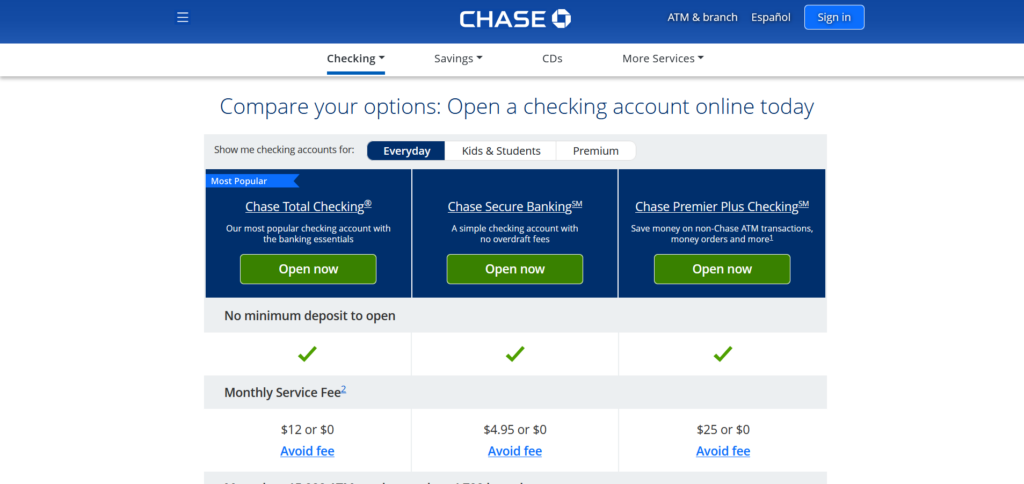

9. Chase Sapphire Banking – Best for Travel Perks

You’ll love their banking option if you’re a Chase Ink business credit card fan. While it requires a hefty minimum balance to avoid fees, the travel benefits, including no foreign transaction fees, make it worthwhile for some nomads. The account provides enhanced rewards on travel and dining purchases, which you can redeem through Chase’s Ultimate Rewards program.

They add significant value for frequent travelers, especially those leveraging the advantages of top-tier bank accounts for digital nomads. Account holders gain access to exclusive travel advisory services and premium customer support, essential for efficiently managing travel-related inquiries and challenges. Furthermore, through Chase’s partnership programs, complimentary access to airport lounges worldwide offers a much-needed respite during long travel days, making it a superb choice for digital nomads looking for comprehensive banking solutions.

Features –

- No foreign transaction fees

- Higher ATM and spending limits

- Relationship rates for investments

- Access to exclusive travel perks

Account Opening Fees – No opening fee, but requires a significant minimum balance to avoid monthly fees.

Plans – Free if you maintain a minimum balance of $75,000; otherwise, $25/month.

Strengths –

- It links with popular Chase Sapphire credit cards.

- Comprehensive travel and purchase protection.

- Extensive ATM and branch network.

- Premium customer service.

Limitations –

- High minimum balance requirement.

- Fees can be high without premium status.

- Limited global footprint compared to others.

- They are focused more on travellers than true nomads.

10. Bunq – Best for Sustainability-Conscious Nomads

Netherlands-based Bunq offers CO2 offsetting and smartphone app management, which is ideal for eco-conscious travellers. The bank’s commitment to sustainability extends to its operations and product offerings. They include paperless statements and a carbon-neutral company footprint. Its flexible account options allow for multiple sub-accounts for various savings goals.

It simplifies financial management for users through accounts recognized among the top banking solutions for digital nomads, all while endorsing eco-friendly practices. Bunq also provides real-time notifications and advanced budgeting tools, helping users track their spending and stay within their financial goals while minimizing their environmental impact. Its dedication to innovation and sustainability makes it ideal for eco-friendly banking.

Features –

- CO2 offsetting for card purchases

- Instant payments

- Multi-currency support

- Environmentally-friendly initiatives

Account Opening Fees – There are no fees for opening an account, although there are monthly fees for accessing premium features.

Plans –

- Easy Money – €8.99/month

- Easy Green – €17.99/month

Strengths –

- Focus on sustainability.

- Innovative app features.

- Real-time transaction notifications.

- Multi-currency support with competitive rates.

Limitations –

- Monthly fees for full features.

- Primarily available in Europe.

- Limited physical card options.

- Smaller network compared to giants like HSBC or Citibank.

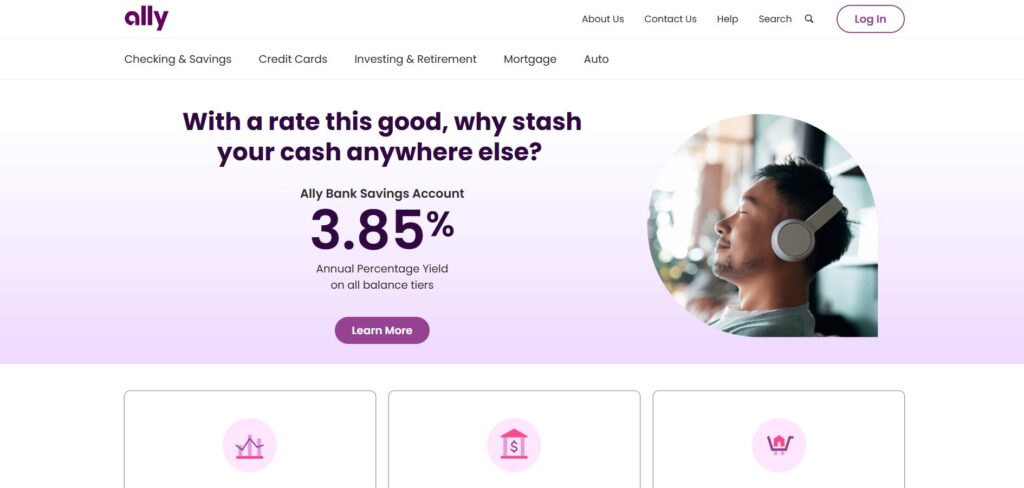

11. Ally Bank – Best for Fee-Free Digital Banking

Ally Bank is renowned among digital nomads for its exceptional digital banking services that do not require maintenance fees. Its focus on providing a seamless online experience makes it a favourite for those who prefer managing their finances online. They offer competitive interest rates on savings accounts and no fees on everyday transactions, making it a cost-effective choice for international living.

It provides robust mobile banking tools, including mobile check deposits and 24/7 customer support, which are indispensable for nomads who are always on the move. Their platform integrates financial tools for budgeting and savings, boosting financial health and mobility globally. Ally Bank supports voice-command banking via Amazon Alexa for convenient, hands-free finance management.

Features –

- No maintenance fees.

- Competitive APY on savings accounts: up to 0.50%.

- Mobile check deposit.

- 24/7 customer support.

Account Opening Fees – No fees for account opening.

Plans –

- Checking Account – Free

- Savings Account – Free

- Money Market Account – Free

Strengths –

- 24/7 customer service with excellent reviews.

- Comprehensive mobile banking application.

- Zero fees for standard transactions.

- High interest rates on savings accounts.

Limitations –

- There are no physical branches.

- Limited capabilities for direct international transactions.

- It does not support multiple currencies.

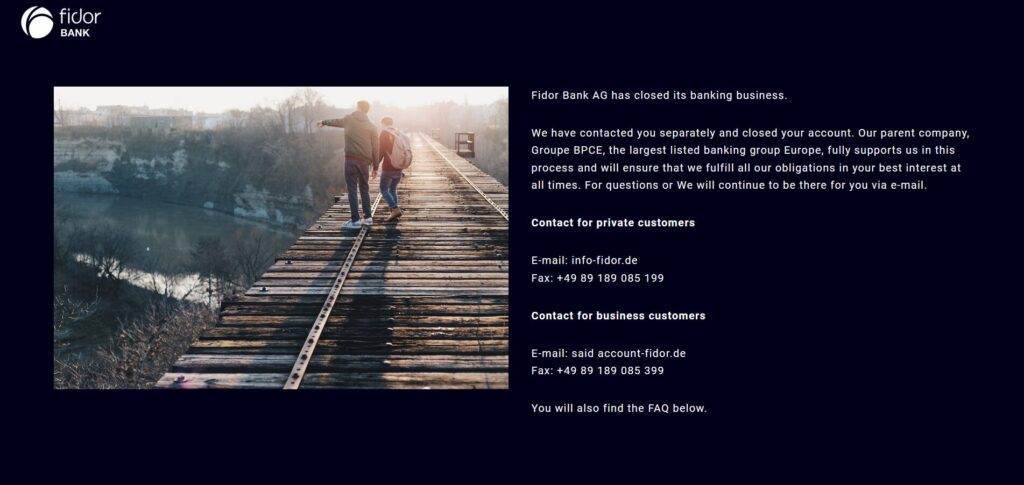

12. Fidor Bank – Best for Tech-Savvy Nomads

Fidor Bank caters to nomads immersed in the digital economy, offering robust integration with fintech and cryptocurrency services. Its platform enhances digital transactions with secure, fast, and innovative banking solutions, perfect for those who rely heavily on digital currencies and online financial services. This integration allows users to seamlessly manage and grow their digital assets while on the move.

Fidor Bank also features an engaging online community where users can share financial advice and insights, enriching the banking experience. Active community participation helps users learn and make informed financial decisions. The bank offers customizable alerts and notifications. It updates users’ finances in real time, essential for effective money management.

Features –

- Cryptocurrency-friendly.

- Integration with various fintech apps.

- Online community for users.

- Cutting-edge digital banking technology.

Account Opening Fees – No fees for account opening.

Plans –

- Smart Current Account – Free

- Smart Savings Account – Free

- Business Account – Monthly fees starting at €5

Strengths –

- Advanced support for digital currencies.

- Extensive fintech integrations.

- Community-driven banking experience.

- Innovative and forward-thinking digital banking services.

Limitations –

- Less traditional banking functionality.

- Mainly available within Europe.

- Primarily online customer service.

13. Barclays International – Best for Expats

Barclays International offers expats global financial services and easy setups from abroad. The bank provides multi-currency accounts and extensive international transfer options, making it convenient for managing finances across different countries. With dedicated expat support and advisory services, clients receive personalized assistance tailored to their unique needs.

Its robust online and mobile banking platforms ensure you can access and manage your funds anytime, anywhere. This accessibility enhances the banking experience for globally mobile individuals. They offer competitive rates on foreign exchanges, reducing costs and complexities associated with currency conversion. The bank ensures secure transactions worldwide with advanced security features.

Features –

- Multi-currency accounts.

- Dedicated expat services.

- Access to a global ATM network.

- Online fund transfer capabilities.

Account Opening Fees – Varies; premium accounts may incur fees.

Plans –

- Personal Banking – Free

- Premier Banking – Monthly fees start at £12 and vary by country and services

Strengths –

- Established global presence.

- It supports multiple currencies.

- Dedicated services for international clients.

- Comprehensive financial services worldwide.

Limitations –

- Some services require high minimum balances.

- Fees for premium services.

- Less flexible on currency exchange than digital banks.

Recommended read – Is Being a Digital Nomad Worth It?

14. ING Direct – Best for EU Residents

ING Direct excels in the EU with its no-fee transactions across Europe and user-friendly digital tools. The bank offers competitive interest rates on savings and checking accounts, appealing to those looking to grow their finances while avoiding excessive fees. It also features seamless mobile and online banking interfaces that simplify account management, even on the go.

Its comprehensive app provides real-time insights into spending, helping users manage their budgets effectively. ING’s customer service is highly responsive and available 24/7 to assist with banking inquiries or issues, ensuring a smooth banking experience for all users. It supports various investment products, allowing clients to diversify their portfolios directly through the same banking platform.

Features –

- There are no transaction fees within the EU.

- Extensive ATM network across Europe.

- Interest rates up to 0.20% on savings accounts.

- Efficient online banking services.

Account Opening Fees – No fees.

Plans –

- Current Account – Free

- Savings Account – Free

- Investment Account – Fees vary based on investment choices

Strengths –

- Zero fees for intra-EU transactions.

- Strong market presence in Europe.

- Accessible digital banking tools.

- Consistently high customer service ratings.

Limitations –

- Services are optimal primarily for EU residents.

- Limited functionality outside the EU.

- There is no support for multiple currency accounts.

15. Santander International – Best for Seamless International Transactions

Santander International caters to digital nomads and expatriates with its robust services for seamless cross-border banking. It offers extensive international services, including multi-currency accounts and straightforward access to foreign exchange services, which are critical for nomads managing finances in multiple countries.

The bank provides global ATM access, adding further convenience for those on the move. It offers no-fee international wire transfers. Its online banking platform is designed for easy navigation and offers advanced security measures to protect user data. It provides personalized customer service, with advisors skilled in addressing the unique challenges international clients face.

Features –

- Multi-currency accounts with the ability to hold and manage money in several major currencies.

- Easy access to foreign exchange services with competitive rates.

- Global ATM network and international branches.

- Dedicated international banking support.

Account Opening Fees – No account opening fees, but minimum deposit requirements apply.

Plans –

- Gold Account – No monthly fee, requires a minimum balance of $5,000 or equivalent.

- Platinum Account – Maintain a minimum balance of $10,000 to waive the $20 monthly fee.

Strengths –

- Convenient for managing finances in multiple currencies.

- Global presence with access to international banking facilities.

- Dedicated customer support for international clients.

Limitations –

- High minimum balance requirements for premium services.

- Fees can be substantial if minimum balances are not maintained.

- Limited to specific regions for full-service offerings.

Best Bank Accounts for Digital Nomads – Frequently Asked Questions

1. What should I look for in the best bank accounts for digital nomads?

When choosing among the best bank accounts for digital nomads, focus on low foreign transaction fees, competitive currency conversion rates, and global ATM access. Multi-currency functionality is especially important if you earn in one currency but spend in another.

Also consider mobile app quality, real-time transaction alerts, customer support availability, and security features like card freeze options. If you travel frequently, unlimited or reimbursed ATM withdrawals can save significant money over time.

2. Are neobanks better than traditional banks for digital nomads?

Neobanks like Revolut, Wise, Monzo, and Starling often provide better exchange rates, lower fees, and more advanced mobile features. They are designed for digital-first users and frequent international transactions.

However, traditional banks such as HSBC, Citibank, or Santander may offer stronger global infrastructure, physical branch access, and broader financial services like mortgages or investment advice. The right choice depends on your travel frequency, income structure, and need for in-person services.

3. Can I open a digital nomad bank account without residency in that country?

Many digital banks allow remote account opening, but residency rules vary. For example, some banks require proof of address in a specific country, while others allow international applicants if they meet identity verification standards.

Before applying, check eligibility requirements, supported countries, and tax reporting obligations. If you maintain ties to your home country, you may need to keep a domestic account active alongside your international banking solution.

4. How do digital nomads avoid high currency conversion fees?

To reduce conversion costs, choose banks that use the mid-market exchange rate and disclose fees transparently. Multi-currency accounts allow you to hold funds in different currencies and convert only when rates are favorable, which is why many travelers choose the best banks to use for international travel.

Avoid using credit cards that charge foreign transaction fees, and always select “local currency” at foreign ATMs or payment terminals to prevent dynamic currency conversion markups.

5. Do digital nomads need more than one bank account?

Yes, many experienced nomads maintain at least two accounts. One may serve as a primary spending account with low international fees, while another acts as a backup for emergencies or savings.

Having multiple accounts reduces risk if a card is blocked, lost, or flagged for unusual activity. It also allows better diversification between currencies and banking systems, improving financial resilience while living abroad.

Take Control of Your Finances, Wherever You Are

Choosing the best bank accounts for digital nomads depends on many factors. These factors include, but are not limited to, ATM fees, currency conversion rates, and international accessibility. Opening an account with a bank that knows the nomadic life means fewer headaches when it comes to financial transactions, no matter where your travels take you. With the right bank, global economic management becomes seamless.

If you want expert guidance in finding the right bank account for your nomadic spirit, we will lead you to the best decision. ?

Don’t hesitate to set an appointment and complete a quick form to start the conversation.

We’re committed to supporting your global adventures through smart banking choices. ?